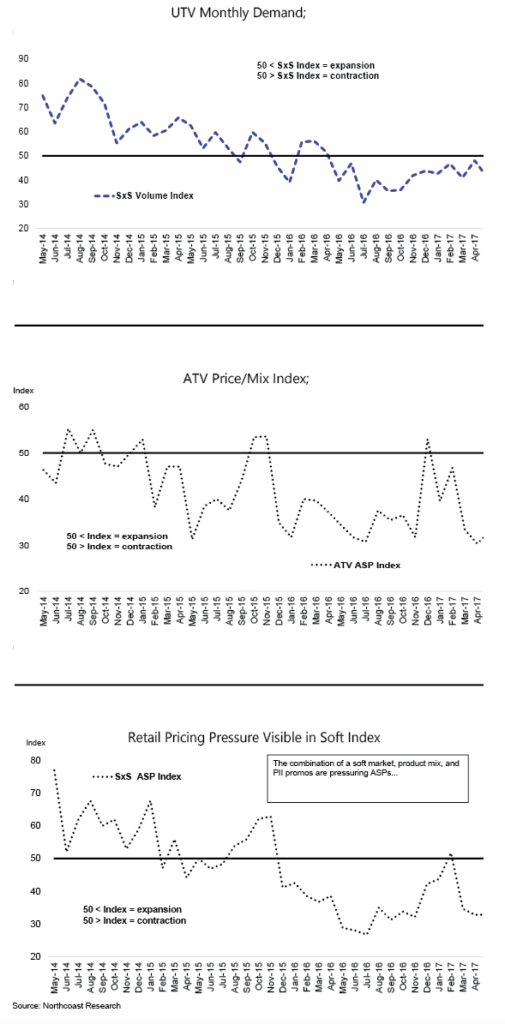

Our latest survey of powersports dealers indicates that the retail sales environment improved sequentially in the month of April. It appears that after starting off slowly (in part due to unfavorable weather conditions), sell-through trends picked up as the month progressed and comparisons eased (lapping the Polaris stop-sale last April).

Now that Can-Am’s Maverick X3 Max is hitting showrooms, it’s looking more and more likely that the new four-seat unit will be hit with consumers. Aside from unique new products, dealers continue to report that aggressive pricing is the driver of new unit sales. Accordingly, we are not surprised by the intense promotions in the marketplace today, which we believe is a function of lackluster demand.

In fact, we think that it is reasonable to questions whether the sales growth some dealers witnessed was a function of a healthier underlying market or simply optics related to a sharp slowdown last April. It remains to be seen, but we expect that our May research will provide answers to this crucial question.

In the heavyweight motorcycle market, dealerships saw weakness continue from March into the month of April. While we questioned the strength of the growth that ORV dealers saw in April, at least it was growth… Specifically, our conversations with motorcycle dealers imply that the market remained soft even though we are making easier comparisons (ON-HWY down -8.3% in 4/16 after a modest -0.2% decline in 3/16).

In our view, the big question that remains among H-D dealers is: how strong will demand be, once carryover inventory has been removed? While we continue to hear favorable commentary about the Milwaukee-Eight platform, it is becoming more difficult to believe that this new platform will drive a meaningful pickup later this year.

Seth Woolf, a research analyst with Northcoast Research Partners, covers the powersports sector within his consumer sector coverage list. Northcoast Research Partners is an institutional equity research firm located in Cleveland, Ohio. For a complete copy of Seth’s research this month, download the PDF at http://bit.ly/2rHY2rm